![[Library!]](books5.jpg) SMP Library

SMP Library

![[Library!]](books5.jpg)

Select Articles of Interest

by John M. Collard, Turnaround Specialist

Strategic Management Partners

A nationally recognized turnaround management firm

specializing in asset and investment recovery, raising capital,

outside director governance, interim executive leadership,

investing in and rebuilding distressed troubled companies.

Feature

Articles

Author

Writing Credits

Firm

SMP Home

Column

Contact

Topics:

Raise Money

Build Value

Invest in Distressed Assets

Benefits of Outside Directors

Value Creation

Leadership

Defense Conversion

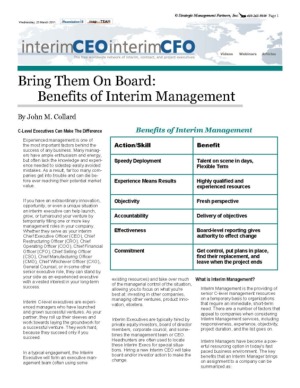

Benefits of Interim Managers

Set Strategy

Phases & Actions in Turnaround Process

Work With Turnaround Pros

Exit Strategies For Practice Owners: Cash Out Alternatives

Liquidate. Start Over.

Compete to Win

Sell To Customers In The Way They Want To Be Sold To

Incentive-Based Mgt

Early Warning Signs of Business Troubles

Presentations

Ebook

Feature Interview

10 Ways to Restart and Improve Profits

Create Value.

|

John M. Collard is a inter-nationally recognized turnaround professional, interim CEO,

private equity advisor, equity capital investor, and outside director; is a frequent speaker, often quoted by the press,

and has authored many articles on the topics;

Is Your Company In Trouble?, Early Warning Signs Pinpoint Business Trouble,

Change Leadership Style to Affect a Turnaround,

Turnaround Mgt and Equity Investing Techniques,

Working With Turnaround Pros to Preserve Value,

Incentive-Based Mgt, Value Creation Model,

Building Value, Asset and Investment Recovery,

Phases and Actions in the Turnaround Process,

Investing in and Rebuilding Underperforming Distressed Troubled Companies,

A Rx to Renewed Health and Asset Recovery,

Benefits of Interim Managers,

Benefits of Outside Directors & Advisors, Raising Money In Tough Times,

Sell In The Way They Want To Be Sold To, Exit Strategies For Practice Owners,

Compete to Win: Build Business Development Team That Will Increase Win Ratio, 10 Ways to Restart and Improve Profits,

and Liquidate. Start Over.

|

The Future. Now.

|

Back to Index

|

-

The Money Is Out There: Keys To Raising Capital In Tough Times

-

- Chief Executive Magazine

- An approach to

raising capital during tough economic times. You need a Three Step Approach utilizing

the Internet, an Overview, Executive Summary, Operating Plan, and a focused list of investors and lenders.

Be the "good deal" and you will raise money.

|

Back to Index

|

-

Turnarounds Explained

Interview With John M. Collard, Chairman, Strategic Management Partners, Inc.

-

- Finance Monthly

- We speak with John M. Collard, Chairman, Strategic Management Partners, Inc.

on all things turnarounds. Most Important Step in the Process, Expectations, Key Steps, Words of Advice, and Benefits of

Outside Director Guidance.

|

Back to Index

Back to Index

Back to Index

|

-

Turnaround Strategist by John Collard

Smart CEO Magazines

-

- Turnaround Strategist

- A Column on Strategy: a compilation of articles by John Collard, Chairman, Strategic Management Partners, Inc.

published by Smart CEO Magazine publications,

including Baltimore, Washington DC, Philadelphia, and New York.

|

Back to Index

Raising Money In Tough Times

Back to Index

|

-

The Money Is Out There: Keys To Raising Capital In Tough Times

-

- Chief Executive Magazine

- An approach to

raising capital during tough economic times. You need a Three Step Approach utilizing

the Internet, an Overview, Executive Summary, Operating Plan, and a focused list of investors and lenders.

Be the "good deal" and you will raise money.

|

-

Raising Money In Tough Times.

Easier Than You May Think

-

- Private Company Director

Directors & Boards

- Private equity funds use a "funnel approach" viewing 1,000 deals

to find 100 worth a deeper review, which result in one or two worth investment.

Present the deal to investors and what is in it for them.

|

|

|

-

Raising Money Capital in Uncertain Times:

There Is Capital For The Good Deals

-

- 8a Magazine

- Dedicated to advancing the US Small Business Administration Set-Aside Program. Providing education,

joint venture and partner opportunities, and a knowledgebase of articles written by experts in business.

It is not hard to raise money if you put the right tools in place and the deal is investable. There is money available,

just be the 'good deal' and you will raise capital.

|

Raising Money In Tough Times: Easier Than You May Think

Turnaround Management Journal

Raising money for under-performing companies:

Easier than you may think

Smart CEO Magazine

Building Value In Companies to Prepare Them For Sale

Back to Index

|

-

A Hands On Approach.

-

- Mergers & Acquisitions, The Dealmaker's Journal, SourceMedia, Inc.

- Executing a turnaround is no easy task. John M. Collard of Strategic Management Partners, Inc.

spells out the guidelines to get an under-performing company up to speed.

As important to cash infusion for working capital needs is to make certain that cash

won't be diverted to past commitments.

|

-

You Must Build Company Value Before You Can Value It

-

- 8a Magazine

-

Dedicated to advancing the SBA Set-Aside Program. Providing

a knowledgebase of articles written by experts in business.

Valuing a company is the easy part; creating that value in the first place so you can measure it

is a more formidable task.

Process of Recovery requires Leadership, Strategy, Quality Management Team, New Business Development,

Sound Capital Structure, Implement Processes, and Nuture Resources.

|

|

|

-

Fixer-Uppers: Rebuilding Company Value To Prepare For Sale

-

- Private Company Director

Directors & Boards

- Valuing a company is the easy part; creating that value in the first place

so you can measure it is a more formidable task. Bring Leasdership, Set Strategy,

Build Management Team, New Business Development, Sound Capital Structure, Implement Processes, and Nuture Resources.

|

-

Investing in Underperforming Companies

A Rx for Renewed Health and Asset Recovery

-

- Buyouts Magazine. Featured Cover Article.

- The newsletter for management buyouts, leveraged acquisitions and special situations.

Investing in underperforming companies can be profitable if you know what to look for and how to execute.

The fundamental premise is to get a company that is turnable, know how to fix the problems,

be able to not spend money on past sins, obtain at the right price, manage the turnaround

and sell at increased value.

|

|

Fixer-Uppers: Rebuilding Company Value To Prepare For Sale

Global Banking & Finance Review

Rebuilding a company's value to prepare it for sale:

Part 1: Finding a viable fixer-upper investment

Part 2: The process of recovery

Smart CEO Magazine

Mining Value From Distressed Companies:

Building Properties In Which Future Buyers Want To Invest

Journal Of Corporate Renewal Magazine

Fixer-Uppers: Creating Pre-Sale Company Value

New Jersey Lawyer, In Re: Special Mergers & Acquisitions Supplement

You Can't Measure A Company's Value Until You First Build It

Baltimore Business Journal, Mergers & Acquisitions

Restart and Improve Profits In Your Company

Back to Index

-

10 Ways to Restart and Improve Company Profits

-

- Small Business Today Magazine

- Restarting companies after Coronavirus shutdown orders is a formidable task.

This requires a change in thinking. Take new products to existing customers.

Take existing products to new customers in new markets.

|

|

Benefits of Outside Directors

Back to Index

|

-

Why Hire Outside Directors When Private Companies Don't Have To?

They Bring Change.

-

- 8a Magazine

- Dedicated to advancing the US Small Business Administration Set-Aside Program. Providing education,

joint venture and partner opportunities, and a knowledgebase of articles written by experts in business.

You need these guys ... to increase cash flow, provide valuable guidance, contacts, and credibility.

Hire that outside director.

|

|

-

Outside Directors Offer Valuable Guidance, Contacts

-

- Baltimore Business Journal

- The Baltimore Business Journal is a publication of American Business Journals

for business leaders and professionals.

Turnaround management expert John Collard discusses adding outside directors to

a private company's board to offer valuable guidance, contacts, and benefits.

|

-

Six Ways Outside Directors Impact Business Growth

-

- Private Company Director

Directors & Boards

- With a board of directors, your company immediately gains legitimacy, and

a panel with expertise that you probably don't have in-house. Outside directors

bring an independent perspective, strategic thinking & planning,

experience & objectivity, contacts, capital infusion, and transactions.

|

|

You Need These Folks --

Six Ways Outside Directors Impact Business Growth

ABF Journal

6 Ways Outside Directors Benefit Business Growth

You Need These Guys

President&CEO Magazine

Benefits of Working With Outside Directors

InterimExecs Network Journal

Outside directors can save troubled companies

(and they're helpful for everyone else too)

Smart CEO Magazine

Value Creation Model To Build Value

Back to Index

|

-

Value Creation Model

Built to Sell

-

- Shareholder Value Magazine

Featured Article

- A primer on how to build a value creation model aimed at achieving the kind of

steady growth that attracts investors and future buyers of the business itself.

The key business attributes and how to create the most value in them are spelled out.

|

-

If You Build It ...

Value Creation Model Shows Buyers Your Company's Worth

-

-

- ABF Journal, Turnaround Corner

- The magazine for the commercial finance professional.

Determining Value is more art form than science. True value can only be established at the time

of a transaction, where a willing buyer tenders payment and a willing seller accepts it in exchange.

Valuing a company is the easy part; creating that value in the first place so you can measure it is

a more formidable task. A Value Creation Model can build worth into your company.

|

|

|

-

Value Creation Model: Built To Sell

-

- Turnaround Management Journal

- Turnaround Management Society publication. Valuing a company is the easy part,

however creating that value in the first place, so that you can measure it is a

much more formidable task.

TMJ

|

Compete to Win.

Build a Business Development Organization That Will Improve Your Win Ratio

Back to Index

|

-

Compete to Win.

Build a Business Development Organization That Will Improve Your Win Ratio

-

- 8a Magazine

- Dedicated to advancing the US Small Business Administration Set-Aside Program. Providing education,

joint venture and partner opportunities, and a knowledgebase of articles written by experts in business.

Concentrate on building a business development organization that will bring in competitive new business.

Bid to win, then manage to profitability and cash flow.

|

Investing in Underperforming Distressed Troubled Companies

Back to Index

|

-

Looking For The Exit:

An Approach To Investing in Underperforming Companies

-

- Dow Jones Bankruptcy Review

Dow Jones & Company Newsletters

- Covering Key Issues and Events in Distressed Situations.

One of a series of opinion columns by leading bankruptcy participants.

Professionals guiding investors or looking to invest in underperforming companies

themselves should be aware of what to look for and how to execute.

|

-

'Distressed Investing' Can Yield Healthy Returns for Savvy Backers

-

- Baltimore Business Journal

- Mergers & Acquisitions Special Edition -- Piecing The Deals Together

The first special publication devoted to Mergers & Acquisitions, BBJ set out to go behind the

deals that had the business community buzzing. BBJ solicited articles from the personalities

behind the art of the deal in Greater Baltimore.

John M. Collard, Chairman, Strategic Management Partners, Inc.

writes "Corporate renewal is a process. It involves using a set of skills to rejuvenate a

company to the state where it can be sold."

|

|

|

-

Mining 'the Gold' in Troubled Companies

-

- ABF Journal Magazine, Turnaround Corner

- The magazine for the commercial finance professional.

Investing in underperformers has become a more acceptable practice. It can be very profitable

if you know what to look for, how to execute, as many buyout firms are finding out. While simply stated,

yet tricky to implement, there is a rewarding process to provide results.

|

Executive Leadership to Enhance Value

Back to Index

Benefits of Interim Management

Back to Index

Phases and Actions in the Turnaround Process

Back to Index

Reviving troubled companies:

Phases and actions in the turnaround process

Smart CEO Magazine

Managing Turnarounds: Phases and Actions in the Turnaround Process

White Paper by John M. Collard

Working With Turnaround Professionals To Preserve Value

Back to Index

|

-

Work With Turnaround Professionals to Preserve Value

-

- Lending and Risk Management News

- The Risk Management Association, formerly Robert Morris Associates; the official association representing

the commercial bankers across the United States. Working with turnaround professionals to improve and preserve value.

An overview of the process provides food for thought.

|

-

Recover & Preserve Value:

Working Successfully With Turnaround Professionals

-

-

Part 1, When is Specialist needed, how to hire

-

Part 2, How Specialist operates, why firms hesitate hiring

-

- ABF Journal, Turnaround Corner,

- Magazine for commercial finance professional. We

discuss when a specialist is needed, how to diagnose company trouble, how to hire and select a

turnaround specialist, how the specialist operates and forges an agreement, and sheds light on why

some businesses are leary of using these specialists.

|

Part 1

|

Part 2

|

-

Turnaround Specialists Can Stave Off Financial Ruin

-

- Baltimore Business Journal

- Banking & Finance Special Edition

The turnaround specialist should work himself out of a job to be most effective. A company's financial

problems often result from mismanagement. When existing management who lead the company into trouble,

doesn't have the skills to deal with crisis, a turnaround specialist may be needed.

John M. Collard, Chairman, Strategic Management Partners, Inc.

writes "The specialist offers a new set of eyes, skills and understanding of troubled situations to

independently evaluate a company's circumstances. Turnaround Specialists add value."

American City Business Journals syndicated this article to 42 cities nationwide.

|

|

Working With Turnaround Professionals to Preserve Value

An Overview of the Profession

TMA Directory of Members and Services

Working with Turnaround Professionals

Commercial Loan Monitor

Turnaround Pros: Who Are These Guys? An interview with John M. Collard

Businesses in Distress:

Is Your Company a Candidate for Failure? (part 1)

Turnaround Financing for Distressed Companies (part 2)

Select, Engage, and Work With Turnaround Specialists to Preserve Value

Journal of Working Capital Management

Exit Strategies For Practice Owners: Cash Out Alternatives

Back to Index

Defense Conversion — Strategies for Federal Government Contractors

Back to Index

-

Defense Conversion, Myth or Mystery?

-

- The Military Engineer Magazine

- A magazine for the engineering management professional. Transition between markets, from and to commercial,

international and federal, is complex business and must be handled by professionals who have been there before.

|

|

-

How to Restructure a Defense Contractor

-

- Successful Restructurings

- Turnaround Corner. Inside the Country's Top Turnaround Firms.

John Collard On: How To Restructure A Defense Contractor. From defense contractor

and part of 'Star Wars' to commercial integrator working to improve the environment. A case study yielding six-fold growth.

|

|

Incentive-Based Management To Get Results

Back to Index

|

-

Managing Employees Through Incentive Compensation

If You Want Results, Show Them The Money!

-

- Fabricator Magazine

- Publication of Fabricators & Manufacturers Association, International.

Provides methodology to incentivize employees based on rewarding teamwork that produces results.

The ultimate goal is to improve the equity value of the company. Incentives are based 50% on what

employees are directly responsible for, 30% on how their performance affects other key elements of the business, and 20% on

their ability to improve equity value or other elements within their control.

|

|

-

If You Want Results ... Show Them The Money!

Incentive-Based Management

-

- 8a Magazine

- Deddicated to advancing the US Small Business Administration Set-Aside Program. Providing education,

joint venture and partner opportunities, and a knowledgebase of articles written by experts in business.

Incentive-Based Management is a catalyst toward improving direction and value creation.

|

Show Them The Money:

A Case For Incentive-Based Management

Smart CEO Magazine

Incentive-Based Management -- Show 'em the Money

Printing Impressions Magazine

Set Strategy — Build Mission Statement for Direction

Back to Index

|

-

Mission Possible:

Six Questions Your Mission Statement Should Answer

-

- BMDO Update

- Publication of National Technology Transfer Center, formerly the Ballistic Missile Defense Organization.

Publication links American Businesses with Ballistic Missile Defense Technology.

Collard writes on the topic of preparing a mission statement to run a company to guide those who are

experts at mission statements to run Missile Defense.

|

|

-

Mission Possible:

Key Elements To A Good Mission Planning Statement

-

- 8a Magazine

- Dedicated to advancing the US Small Business Administration Set-Aside Program. Providing education,

joint venture and partner opportunities, and a knowledgebase of articles written by experts in business.

What does your mission statement say to others? Make certain that it conveys direction and states why you are the

company to choose to deliver results.

|

Sell To Customers In The Way They Want To Be Sold To

Back to Index

|

-

Fast 50:

Focus On Retention Over New Customers

-

- Baltimore Business Journal

- There are only two ways to grow revenue.

1) Sell new products and services to existing customers.

2) Sell existing products and services to new customers.

Most importantly is to sell to your customers in the way that they want to be sold to.

|

Early Warning Signs of Companies Heading For Trouble

Back to Index

|

|

-

Deathbed Businesses:

When a Business Stops Growing. It Starts Dying.

-

- Baltimore & Washington Smart CEO Magazines

- Too often, companies die unnecessarily because most business leaders haven't learned to

recognize the symptoms of oncoming illness in their business. The

obvious signs of business trouble are rarely its root causes. John M. Collard

of Strategic Management Partners, Inc.

spells out some early warning signs of trouble.

|

-

Is Your Company In Trouble?

-

- The Corporate Board Magazine

- The Journal of Corporate Governance, for the directors of Fortune 1000 companies. There are early warning signs to

gauge corporate health, management effectiveness, and predict when a company is headed for trouble.

|

|

|

-

Steering Clear of the Brink

-

- The Journal of Private Equity

- Strategies and Techniques for Venture Investing. Published Quarterly by the Institutional Investor, Inc.

In looking at portfolio companies, John Collard notes that differences in leadership style can be an early warning sign of impending trouble.

In addition to leadership style, he notes 10 other common signs of difficulty.

at JPE

|

-

Danger Signals: Is Your Company At Risk?

Early Warning Signs Pinpoint Business Troubles.

-

- 8a Magazine

-

Dedicated to advancing the US Small Business Administration Set-Aside Program. Providing education,

joint venture and partner opportunities, and a knowledgebase of articles written by experts in business.

Obvious signs of business trouble are rarely its root causes. Losing money, for example, isn't the problem.

Rather, losing money is the result of other problems.

|

|

Is Your Company at Risk?

Here are some early-warning signs that pinpoint business troubles.

Strategic Finance Magazine

Liquidate. Start Over.

Back to Index

Presentations & Programs on Building Value and Investing

Back to Index

|

-

Buying and Managing Distressed Companies

-

- Thomson Venture Economics' Buyouts Symposium

-

Buyouts Magazine is the newsletter for management buyouts,

leveraged acquisitions and special situations.

A Symposium Special Panel was moderated by John M. Collard, Chairman, Strategic Management Partners, Inc.

This article is excerted with permission from the panel discussion.

|

-

Competition for Good Distressed Deals Is Intense

Investors Warn: Be Skeptical, Hands-On, Disciplined

-

- The Journal of Corporate Renewal

Official Publication of the Turnaround Management Association,

the premier professional community dedicated to

corporate renewal and turnaround management.

- Excerpted with permission from "Buying and Managing Distressed Companies,"

a panel at Thomson Venture Economics' Buyouts Symposium.

The panel discussion was moderated by

John M. Collard, chairman of Strategic Management Partners, Inc.

|

|

|

-

A Primer For Corporate Renewal

-

- A Primer for Corporate Renewal

-

Published by the Turnaround Management Association featuring pertinent articles to help turnaround practitioners,

consultants, private equity investors, bankers, lenders, and lawyers. Authors include: Tom Peters,

Abraham Zaleznik, Rosemary Bowes, Phyllis Gillis, Jack Butler, Richard Walters, John Collard and others.

|

-

Western Turnaround Management and Equity Investing Techniques

-

- World Bank, Economic Development Institute

- A course developed for World Bank to teach the Privatization Agency, Bankruptcy Agency officials, and industry leaders the way turnaround management and investing is carried on in the western world. A 'train the trainers' course now being delivered throughout Russia, the former USSR countries, and Central Europe.

|

|

Back to Index

Select writing credits include Buyouts Magazine, Director’s Monthly, Directorship, The Corporate Board,

Private Company Director, Director's & Boards, Smart CEO Magazine, InterimCEO News, InterimExecs News, Mergers & Acquisitions,

Venture Capital Guide, The Journal of Private Equity, Shareholder Value Magazine,

Valuation Issues Magazine, Strategic Finance Magazine, Financial Executive Magazine, Institutional Investor,

Commercial Law Bulletin, New Jersey Lawyer, Successful Restructurings, Dow Jones Bankruptcy Review, ABF Journal,

Printing Impressions Magazine, Print Profit Magazine, Military Engineer,

BMDO Update, Manage Magazine, Contract Management Magazine, The Fabricator,

Secured Lender, Lending and Risk Management News, RMA Journal,

Commercial Loan Monitor, Journal of Working Capital Management,

Journal of Business Strategy, Journal of Corporate Renewal, Turnaround Management Journal,

Wealth & Finance Magazine, Chief Executive Magazine, Global Banking $amp; FinanceMagazine,

International Business Magazine, Becker's Hospital Review, Physician Leaders Journal,

among others.

In addition, we have been quoted or featured in the Wall Street Journal,

Washington Post, Baltimore Magazine, Baltimore Sun, Warfield’s Business Record,

The Daily Record, Washington and Baltimore Business Journals,

Gazette of Politics & Business, Success Magazine, Bloomberg Magazine, Europe Magazine, Bankruptcy Court

Decisions, International Treasurer, M & A Magazine, Turnaround & Workouts Magazine, ABF Journal,

President&CEO, 8a Magazine, Corporate Live Wire, Finance Monthly, Board Leadership, and others.

![[Marble]](marble.gif) About the Firm

About the Firm

![[ tsigetarts]](eagleosr.gif)

Strategic Management Partners has

substantial experience advising corporations and individuals on the strategic

and mechanical issues of corporate development and governance, operating management and

turnarounds for asset recovery, outside director leadership, and investing in and rebuilding underperforming companies.

Our principal has over 35 years experience in

P/L Management, Strategic Planning and Repositioning, M & A for Strategic

Advantage, Finance, Investing, Raising Funds, Sales/Business Development,

Building Selling and Marketing Teams, and Operational Auditing = In Public &

Private companies = In healthy and crisis situations.

We work with and support the equity capital community to provide assessment studies to determine

the situation, planning and strategy development to direct the company, crisis management to

oversee that assets are not squandered away, workout teams that recover assets, and board level

oversight to keep the client headed in the right direction.

We seek strategic alliances with private equity funds.

www.StrategicMgtPartners.com

www.StrategistLibrary.com

Back to Index

Contact

We welcome constructive inquires. More information is available if required.

There is more to Strategic Management Partner's

Return to Home Page

Contact Information

Contact Information

Index

John M. Collard, Chairman

Strategic Management Partners, Inc.

522 Horn Point Drive

Annapolis, Maryland [MD] 21403

Voice 410-263-9100 Facsimile 410-263-6094 E-Mail

Strategist@aol.com

About the Principal

About the Expert

We serve as experts for comment or quote, please contact us at 410-263-9100

We welcome constructive inquires, please send via E-Mail to:

Strategist.

Copyright © 1990-2023

Strategic Management Partners, Inc.

PDF

PDF

![[Library!]](books5.jpg) SMP Library

SMP Library

![[Library!]](books5.jpg)

![[Library!]](books5.jpg) SMP Library

SMP Library

![[Library!]](books5.jpg)

![]()

![]()

![]() Featured Article

Featured Article

![]() Feature Interview With John Collard

Feature Interview With John Collard

![]() E-Book by John Collard

E-Book by John Collard

![]() 8a Magazine Column by John Collard

8a Magazine Column by John Collard

![]()

![]() Smart CEO Column by John Collard

Smart CEO Column by John Collard

![]() Articles Of Interest

Articles Of Interest

![]() Writing Credits

Writing Credits

![]()

![]() About the Firm

About the Firm

![]()

![]()

![]() Contact Information

Contact Information ![]()

![]()

![]() PDF

PDF